You will find most of the Business Strategy Game Quiz 1 answers below. The YouTube Video above covers both topics. The second topic is on how the bsg-online operates. The first topic is where the company starts out.

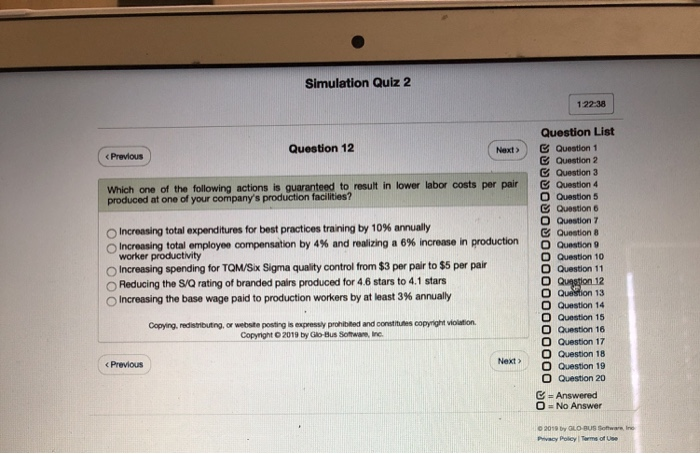

Therefore the debt ratio is 27%, and the balance being 73% is equity.Business Strategy Game Quiz 1 primarily consists of two topics. To figure out the correct ratio, the formula for debt ratio= debt/(debt+equity) So debt is simply Long term debt at $33,000 But then what? Believe it or not, but current liabilities isn’t part of “debt”. Total Equity shows itself at $90,000, so that’s easy.īut the real hard part is deciphering what debt is. So to answer this question, we must look at this income statement and conclude what debt and equity is. L-T Debt (draw against credit line) $33,000īased on the above figures, the company’s capital structure consists of what debt and equity percentages? (These percentages are one of the components used in determining the company’s credit rating, as explained on the Help screen for the Comparative Financial Performance page of the GSR.) Given the following Financial Statement data: Here’s one example question that you will most likely get. Many of the questions are financial based. Both quizzes will go over concept basics of the game, and especially Quiz 2 can have very difficult questions. You will most likely be taking two quizzes in this course, Glo-Bus Quiz 1, and Glo-Bus Quiz 2. If you’re in a business strategy class, you may be taking the Global Business Simulation Strategy Game, or for short, “Glo-Bus”.

0 kommentar(er)

0 kommentar(er)